8 Ways to Save Money on Your OSAP Loan

Tips and tools to save you money on your OSAP loan!

By Stefan Kollenberg

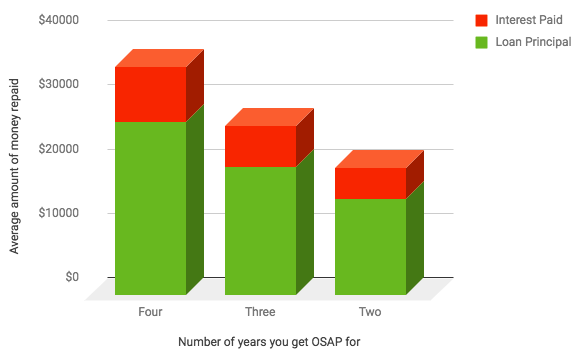

Did you know that if you take the average amount of time to pay off your student loans, you could end up repaying $8,500 worth of interest for a $27,000 loan? When I found out, I was shocked, because — let's be real — OSAP feels like free money at first.

After learning this, I did some more in-depth research to find out how I could save money on my OSAP loans. Here are the tips and tools that I'd like to share with you!

8. When do I have to start repaying my OSAP loan?

You need to start paying back your OSAP loan six months after your study period ends.

BUT consider the next question...

7. When do I start getting charged interest on my loan?

You get a 6 month grace period where you will not be charged interest on the provincial portion, but you will be charged for interest on the federal portion of your loans during this period. Your OSAP loan is 60% federal and 40% provincial, so during this initial grace period you will still owe significant interest to the federal government. If you can, start making repayments during your grace period, or even while you're still in school to save some interest!

6. You may owe more than you think!

You may be unpleasantly surprised to find out that if your study plans changed after receiving your OSAP, you may have received an excessive grant or bursary. This excess needs to be paid back to the government.

5. Alternative payment methods to save you money and preserve your cash.

I learned you're able to pay your OSAP loans using loyalty points! Click here to see how a very cool company called HigherEdPoints.com can help you save some money on your loan repayments by using loyalty points (anyone's points: your parents, grandparents and even those of your boss!).

Important Points for Recent or Soon-to-be Grads

4. Prolonging your grace period

If you own or co-own a new business in Ontario, or you work / volunteer with a not-for-profit organization, you may be eligible to extend the interest free period of your loan. See details via the

application form here (pdf.

3. Check your monthly payment amount

If you land a job coming out of school, look into how much you can afford to put down on your loan. If you're able to increase your monthly payments you could easily save thousands in the long term.

Check out this helpful repayment calculator provided by OSAP.

2. Are you eligible for repayment assistance?

Once you leave school you may be eligible to receive repayment assistance from both the federal and provincial governments. They evaluate your family income and how much you earn from your current job to see if you are eligible. Check here to see if you're eligible for repayment assistance.

1. Who do you have to pay back?

You actually don't pay money back to your school or OSAP — you repay the National Student Loans Service Centre. This is a common mistake made by students every year!

Next steps to saving money on your OSAP loan

OSAP is just one source of funding, there are many more you can take advantage of! Check out this overview of other sources alongside tips on taking advantage of them.

A little more about HigherEdPoints.com

Founded in 2013 with the aim to help students and families tap into new and innovative sources of funds for education, HigherEdPoints is the first company in the world to enable the conversion of loyalty points into funds for tuition and student loan repayments. To learn more, visit www.HigherEdPoints.com.